Management Update TMX: UDA.UN March 2017

Equity markets in the United States were flat in March. The U.S. (S&P 500) fell by less than 0.1% and Canada (S&P/TSX Composite Index) moved up 1.0%. Europe (Euro Stoxx 50) gained 5.5%, and Japan lost (Nikkei 225) 1.1%.

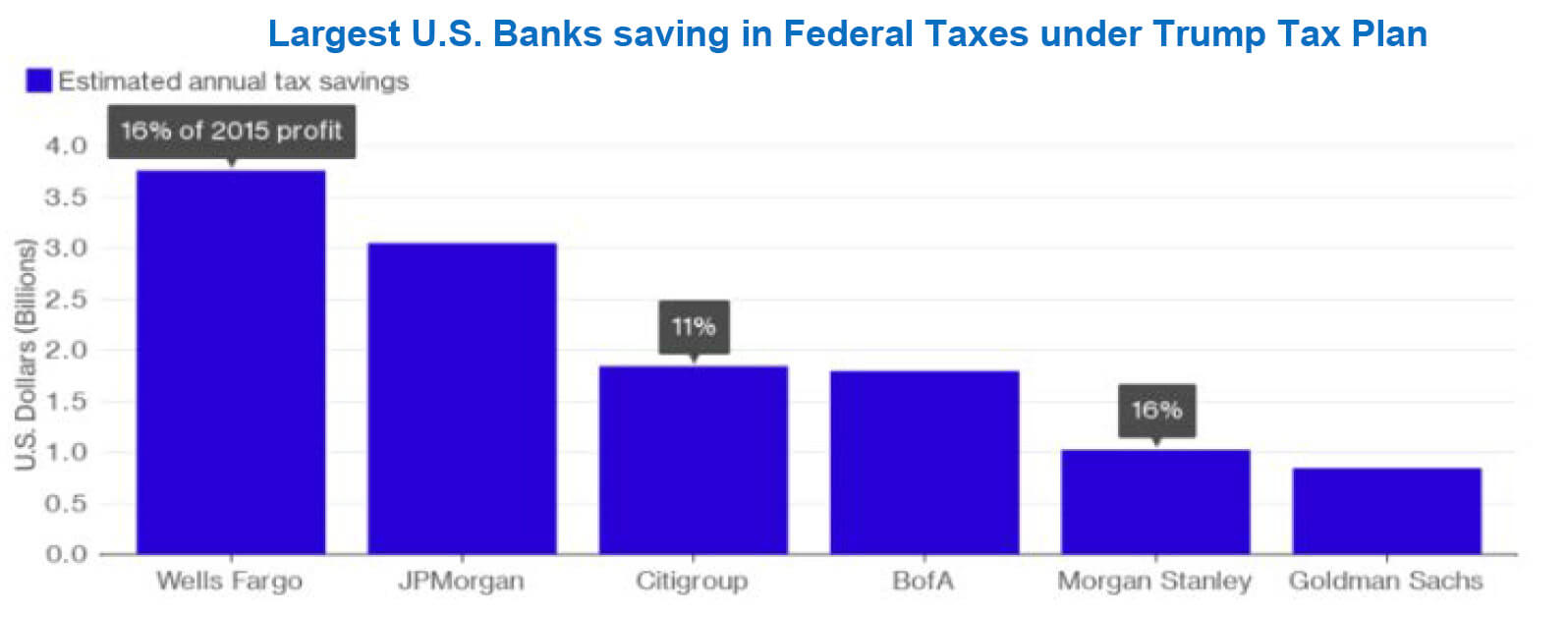

Equity markets in North America slowed down in the month of March. The first hundred days of Donald Trump’s presidency have failed to live up to the hype of his campaign and equity markets have justifiably paused. Investors want to see his administration start to “walk the talk” before they are comfortable moving U.S. equities to new all time highs. The recent failed attempt to alter the American Health Act (“AMA”) means that executing tax reform is paramount for this administration to establish legitimacy. Investors need to see that President Trump can work effectively with the federal legislature. The tax reforms proposed – a reduction in the corporate tax rate, one-time tax holiday for U.S. corporate profits held abroad, full first year depreciation of fixed asset investment, border adjustment tax – would be a meaningful catalyst to the U.S. economy, especially in fixed capital investment (which is a main driver in labour productivity and economic growth). The Trump administration has taken steps to reconcile with Washington insiders. The removal of Chief Strategist, Steve Bannon, from the National Security Council has been an olive branch to lawmakers. Mr. Bannon was instrumental in putting forward the “Drain the Swamp” message in President Trump’s campaign and is generally disliked by Democrats and Republicans alike. His status in the Trump cabinet has provoked the Washington establishment that effectively makes Washington operate. They also have the power to bring it to a halt. President Trump has now come face to face with this power. Mr. Bannon’s demotion signals that the administration is ready to start making deals rather than enemies. First on the agenda is tax reform.

Source: Bloomberg

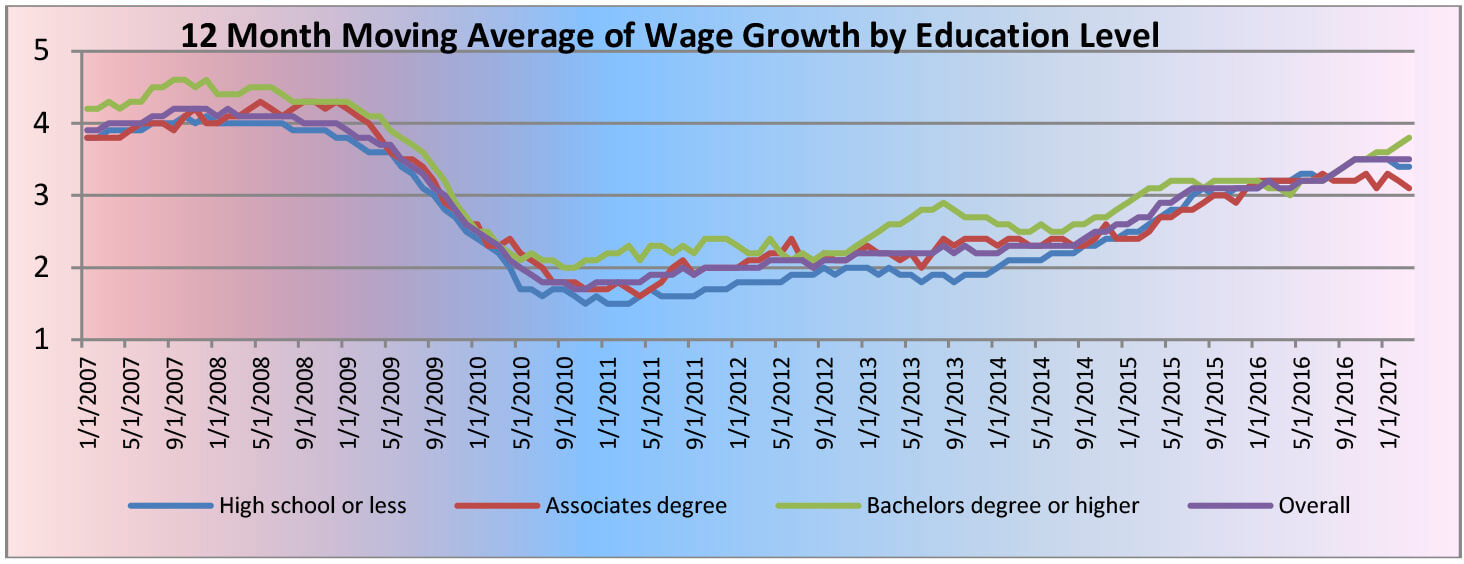

This sets up a favourable backdrop for the American financial sector. 1) The Federal Reserve (“The Fed”) wants to raise interest rates twice more in 2017, increasing bank’s net interest margin. 2) Wages have risen across all education segments of the economy, driving housing demand and credit growth. 3) Tax reform, if enacted is expected to increase financial sector earnings meaningfully and 4) Risk capital requirements are expected to be loosened. This last point is important because it sets up American banks to finally start returning significant amounts of capital to its shareholders. It is projected that leading banks will return about 90% of their earnings to shareholders in the coming year and it is possible many will return 100%. While banks are a play on the economy, they have some of the lowest valuations of any stocks in the S&P 500. The American major banks trade around 12 times 2017 earnings, far below the 18 times for the S&P 500 as a whole. Big banks typically trade at a lower valuation than smaller, regional banks because of greater complexity, tougher capital requirements and more regulatory scrutiny. For the first time in over a decade, these hurdles appear to be declining rather than advancing. Even with the major run up in financials in the last six months, this sector remains cheap.

Source: Federal Reserve of Atlanta

Global tensions are mounting. The possibility of military confrontation in Syria and North Korea is increasing. Venezuela is close to revolution as triple digit inflation and major supply shortages grip the once prosperous South American nation. If the geopolitical climate deteriorates further then it is possible that the international oil trade could become disrupted. For the past two and a half years, high U.S. oil inventories have been viewed through a bearish lens but this perception could change. If conflict were to break out then a major risk premium will be added to oil. Currently, the U.S. consumes roughly twenty million barrels of oil a day and produces fewer than ten million. Even if domestic producers can ramp up production by a million barrels a day, the U.S. will still be short some nine million barrels. Large domestic inventories of crude should keep a ceiling on this. The U.S. holds 540 million barrels of oil currently and could easily weather a supply shock. Relatively speaking, the U.S. is in a position of major advantage if global tensions do escalate.

Canada had positive economic data in March. the Bank of Canada (“BoC”) made it clear that they are still looking to see more growth and potential before considering an increase in interest rates. The BoC does not expect excess capacity to be absorbed in the economy until sometime in the middle of 2018. This seems correct given all the economic slack that the oil downturn caused in western Canada. Initially, perception was the BoC might raise interest rates to cool down excesses in the housing markets, especially in Toronto and Vancouver, but this seems to be off the table. It appears they have left this to the federal and provincial governments to contain and remain focused on inflation targeting. The Canadian Dollar (“CAD”) will most likely remain under pressure versus the U.S. Dollar (“USD”) as the Fed raises rates and BoC stand pat.

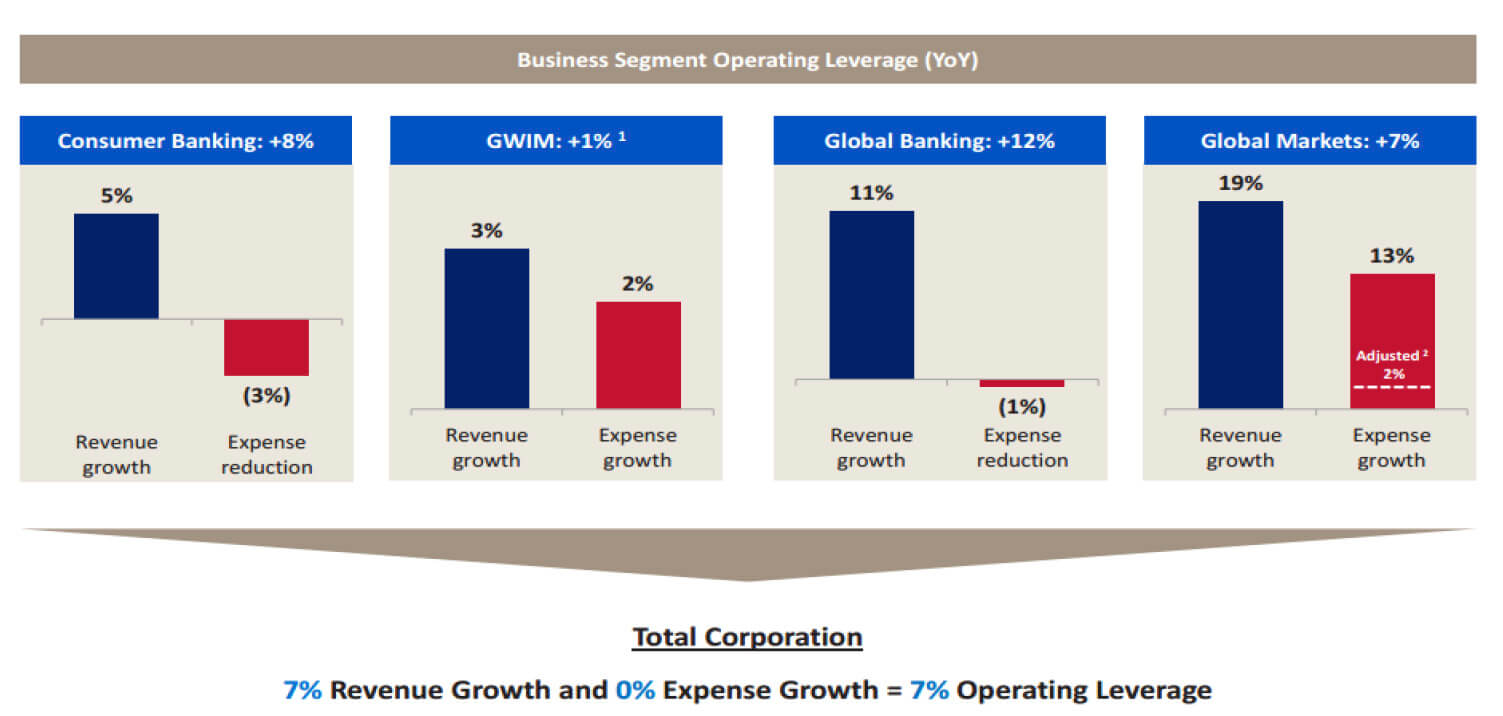

The Fund’s Managers remain bullish on U.S. financial institutions, especially national money-center banks. Of these, Bank of America (NYSE:BAC) may have the strongest growth story of its peers. BAC’s 2017 Q1 net income of USD $0.41 far exceeded analyst estimates of USD $0.35. The main driver of this was by BAC’s lucrative Myrill Lynch division which continues to deliver high returns. The firm’s trading unit had revenue on par with 2009 (when volatility was at all time highs) with a fraction of the risk. Revenues in Global Markets grew 19% while expenses – net of legacy litigation expenses from the financial crisis – grew only 2%. BAC as a whole grew revenues by 7% year-over-year (“YoY”) while its expenses were flat. Increasing the operating leverage by 7% for a globally systemic international bank is nothing short of fantastic. This helps confirm that BAC is focusing on what it calls “responsible growth” which is using a strategy of generating sustainable earnings growth without taking undue risk. Earnings per share at BAC are viewed by analysts to rise 20% in 2017 and 16% in 2018 which reflects the U.S. focused bank’s outsized benefit from rising interest rates. The cost of consumer deposits should increase slowly as short term rates increase while the bank will be quick to take advantage of lending into a rising rate environment and growing their loan book in an expanding economy. BAC will use this increase in earnings to return capital to shareholders in the form of share repurchases and dividend increases.

Source: Bank of America Investor Relations

We believe that BAC will be a strong performer in 2017. A rising interest rate environment and tax reform should drive loan growth and net interest margin expansion in the financial industry.

Unitholders are reminded that the Caldwell U.S. Dividend Advantage Fund offers a Distribution Reinvestment Plan (“DRIP”) which provides Unitholders with the ability to automatically reinvest distributions and realize the benefits of compounded growth. Unitholders can enroll in the DRIP program by contacting their Investment Advisor.

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/