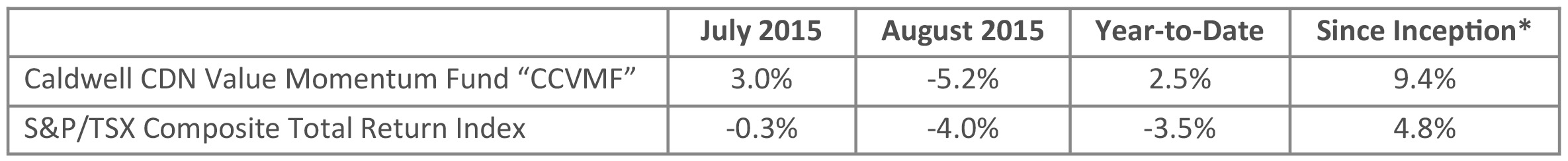

Update on Caldwell Canadian Value Momentum Fund July/August 2015

* Compounded Annual Return since August 15, 2011

July Recap: The Fund gained 3.0% in July versus a loss of 0.3% for the TSX Total Return Index. This marks the 15th time the Fund outperformed when the benchmark had a down month. Since inception, the fund performed better in 15 of 20 down months for a success ratio of 75%. The portfolio’s strength was broad based with over 60% of the Fund’s holdings posting positive returns. Uni-Select, a recent purchase made this past June, was the strongest performer with a gain of 25%. The company is consolidating the automotive paint distribution market in the U.S. and automotive parts distribution market in Canada. It reported very strong margin performance in Q2 and has announced further acquisitions in British Columbia, Nova Scotia and Colorado. The Fund also did well by avoiding harmful parts of the market. Specifically, the Fund had no exposure to the energy or materials industries which declined 15% and 7% in July, respectively.

Three stocks were added to the portfolio in July: Premium Brand Holdings (PBH), Air Canada (AC) and Hardwood Distribution (HWD). PBH produces and distributes premium, specialty foods. It is benefitting from consumer trends away from mega-brand, mass produced food. Air Canada operates Canada’s largest airline and is seeing good trends from its cost restructuring initiatives. Hardwood Distribution sources and distributes rare woods from overseas for use in cabinetry and other applications, primarily in the U.S. It is benefitting from strong renovation & remodel and housing trends.

August Recap: The Fund declined 5.2% in August versus a loss of 4.0% for the TSX Total Return Index. While the Fund’s performance year to date has been dominated by the strength of security selection – our stock holdings have simply performed better than the overall market – there are times when risk exiting the market is broad-based and overpowers individual company catalysts. This is what happened in the month of August. The market sell off culminated on Monday, August 24, a day in which the Index lost 3.1%, making it the worst single day sell-off in 2015. Volatility that day was extremely high, with many stocks having intra-day moves of 20%+, and selling was broad based, with only 8 stocks, or 3% of the Index, showing a positive return in the week ending August 24th.

The Fund has risk controls that are designed to protect investors from large negative shifts in market sentiment. These risk controls prompted the Fund to aggressively move to cash so that only 56% of the Fund was invested going into the worst day of the year. The market has moved higher from its August 24th low and the Fund has subsequently reduced its cash balance by increasing its exposure to the strongest names in the portfolio and by adding a new position in Celestica, an electronics manufacturer that we expect will see continued margin expansion as revenue growth accelerates.

The Fund ended August with a 30% cash balance. Year to date, the Fund has outperformed the Index by 600 basis points, posting a positive return of 2.5% versus a loss of 3.5% for the Index. Looking forward, we continue to identify stocks with near-term catalysts to unlock value. Should risk continue to exit the market, the Fund is well positioned.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Belinda Rossihttps://caldwellinvestment.com/author/belinda/

-

Belinda Rossihttps://caldwellinvestment.com/author/belinda/

-

Belinda Rossihttps://caldwellinvestment.com/author/belinda/

-

Belinda Rossihttps://caldwellinvestment.com/author/belinda/