Update on Caldwell Canadian Value Momentum Fund November 2015

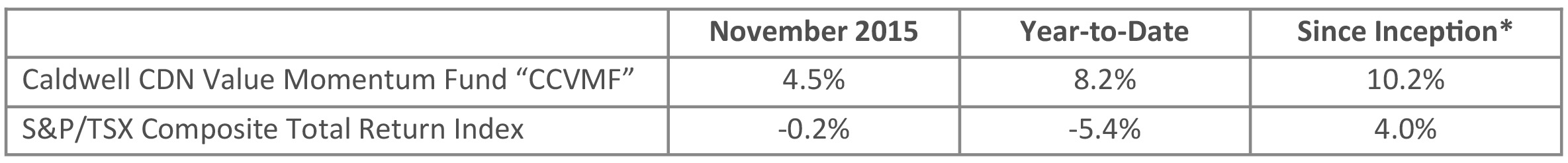

*Compounded Annual Return since August 15, 2011

November Recap: The Fund gained 4.5% in November versus a loss of -0.2% for the TSX Total Return Index. November marks yet another month that the Fund outperformed when its benchmark declined. Since the Fund’s inception in August 2011, there have been 22 instances where the TSX had a negative month. Of those 22 months, the Fund outperformed in 17 months (77% success ratio) and posted a positive return in 10 months, a testament to the strong downside protection of the strategy.

Strength in Energy last month proved to be a head-fake as the sector was down sharply again in November (-4.1%), making it the worst performing sector in the market. The Fund continues to avoid those areas of the market that have caused substantial grief to investors this year: Energy, Materials and Health Care.

Top performers in November were New Flyer Industries (+38%), CCL Industries (+20%) and Boyd Group (+14%). New Flyer moved higher on a number of positive catalysts: 1) Q3 results showed continued improvement across all operating metrics; 2) the company continues to announce new order wins, which we expect will continue on the back of the recent passing of a U.S. transportation bill, the first long term spending commitment since 2005; and 3) the announced acquisition of MCI, which has the largest installed base of motor coaches in North America. The deal is attractive on a valuation basis and cost synergies seem conservative. CCL and Boyd also released quarterly results, which continued to impress with an attractive combination of organic and acquisition growth.

Two stocks were added to the portfolio in November: Rogers Communication (RCI.B) and Exchange Income Corporation (EIF). Rogers was purchased on the back of strong execution of its Rogers 3.0 plan, which drove two consecutive quarters of strong net adds and retention. Data speeds are becoming increasingly important to consumers, and this is where Rogers has an advantage. Exchange Income Corporation acquires companies in niche aviation and manufacturing. Their business model is to grow the dividend through the purchase of cash flow-producing businesses. Upcoming catalysts include margin expansion from recently completed restructuring initiatives and synergies from acquisitions.

The Fund ended the month with a 13% cash position.

Looking forward, we continue to identify stocks with near-term catalysts to unlock value.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/