November Recap:

The Fund gained 0.2% in November versus a gain of 0.5% for the S&P/TSX Composite Total Return Index ("Index”). Traditionally defensive sectors such as Consumer Staples (+3.7%), Telecom (+2.4%) and REITs (+1.7%) out-performed the more cyclical sectors. Industrials (-1.5%), where the CCVMF has its largest exposure, was the worst performing sector in the market; however, security selection was strong as the fund’s weighted average return across its Industrials stocks was +1.5%.

Top CCVMF performers in November were Martinrea (+21.5%) and Empire Group (+11.2%). Martinrea moved higher on the back of a strong earnings report in which the company raised its long-term operating margin guidance. Martinrea is on track to double its margin level over the 2013-2019 period on the back of operational improvements, better pricing discipline and product mix. Empire moved higher on a third consecutive quarter of food inflation after 11 months of deflation. While this is positive for all grocers, Empire is also benefiting from company-specific catalysts as it announced details on a round of spending cuts that are part of a broader restructuring plan.

No stocks were added to the portfolio in November.

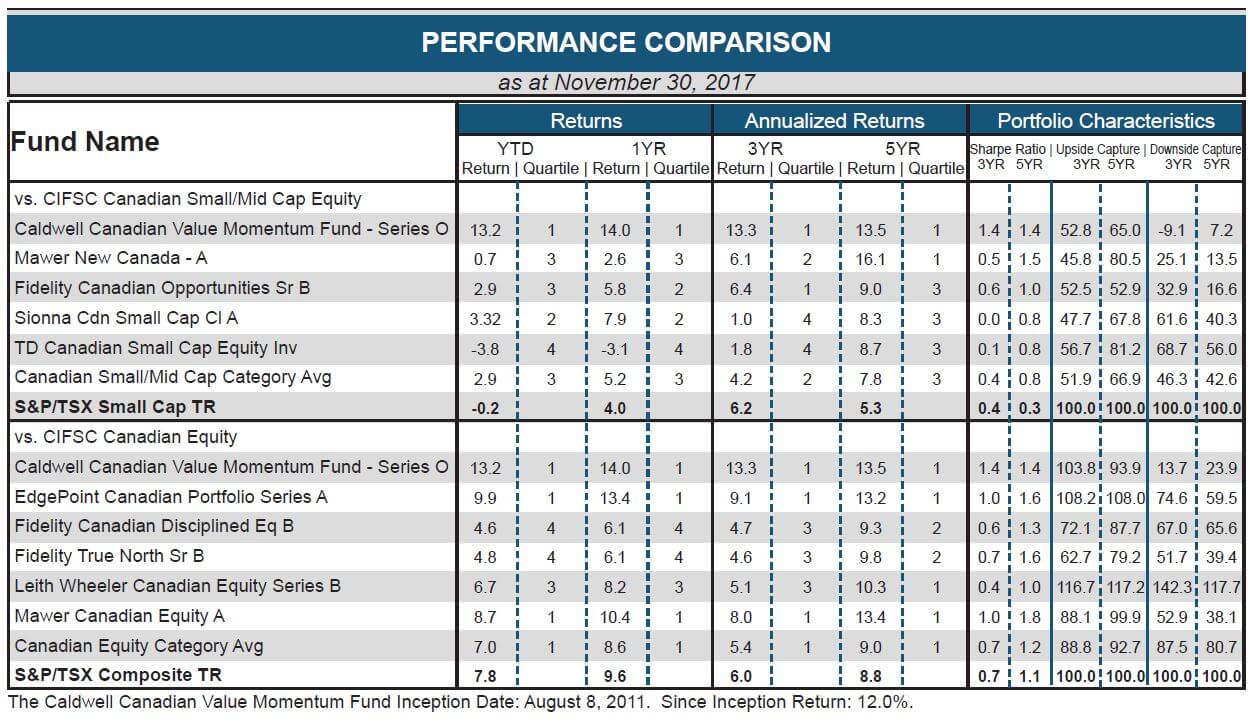

The CCVMF has significantly outpaced its benchmark over its 6+ year history and we were recently asked how we do that: what is our edge? Our answer is that it's a combination of two things. First, our proprietary factor model helps us identify companies with strong catalysts. There are very good things happening at these companies to drive their share prices higher. The second important piece is that we own a concentrated portfolio of these high-catalyst names. One can think of the CCVMF in terms of a steak versus a sausage. There is no 'filler' in the CCVMF. The combination of owning a concentrated group of only high-catalyst names results is a portfolio with the ability to significantly out-perform the market.

The Fund held an 33% cash weighting at month end. The relatively higher cash balance is a function of two factors:

- There is often a lag between when stocks are sold from the portfolio to when new names are added which creates a cash balance. We executed on a number of sell signals following relatively tepid earnings reports and are now waiting for our proprietary model to produce buy signals and subsequently work through the due-diligence. We expect cash balances to move lower as we progress through this process.

- Investors are acknowledging the CCVMF's ability to generate alpha and the fund has started to see significant money flow into it. Our priority is to ensure this money gets wisely deployed into the market.

In the meantime, we look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

We thank you for your continued support.

The CCVMF Team

The information contained in this document is designed to provide general information related to investment alternatives and strategies and is not intended to be investment or any other advice applicable to the circumstances of individual investors. We strongly recommend you to consult with a financial advisor prior to making any investment decisions. Unless otherwise specified, information in this document is provided as of the date of first publication and will not be updated. All information herein is qualified in its entirety by the disclosure found in the CCVMF’s most recently filed simplified prospectus. Information contained in this document has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing in this product. Unless otherwise indicated, rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The CCVMF is a publicly offered mutual fund that offers its securities pursuant to simplified prospectus dated July 20, 2017. The CCVMF was not a reporting issuer prior to that date and formerly offered its securities privately as follows: Series F and Series I since March 28, 2014 and Series O since August 8, 2011. The expenses of the CCVMF would have been higher during the period prior to becoming a reporting issuer had the fund been subject to the additional regulatory requirements applicable to a reporting issuer. Inception Date: August 8, 2011. Principal Distributor: Caldwell Securities Ltd.

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/