June Recap:

The Fund gained 0.4% in June versus a gain of 1.7% for the S&P/TSX Composite Total Return Index ("Index”). The Index was driven by strong performance in Energy (4.8%) on a 10%+ increase in the price of crude oil. Consumer Staples (+3.0%) was also a strong performer but remains in negative territory year to date (-3.3%). Despite the Index's strong performance in June, the Industrials and Financials sectors both posted negative returns (-0.6% and -0.2%, respectively).

Top CCVMF performers in June were Empire Company (“EMP”: +5.7%) and Methanex (“MX”: +4.9%). Empire reported quarterly results with management sounding increasingly confident in its cost cutting targets and signaling a shift from internal restructuring to growth initiatives. Shares of Methanex continued to move higher as global pricing remains robust on strong demand and lack of supply, causing analysts to revise earnings estimates higher.

One stock was added to the portfolio in June: Kirkland Lake Gold (“KL”). Kirkland Lake is a gold producer with mines in Ontario and Australia. The company has a significant pipeline of high-quality exploration projects and is seeing strong production growth, having produced 596,000 ounces in 2017 versus 314,000 ounces in 2016. Growth is being driven by the company's Fosterville mine which has seen significant increases in mineral reserves and grade on the back of strong drilling results. This includes a discovery in the mine's Swan Zone that contains grades as high as 61 grams per tonne, making it one of the highest grade mines in the world. The company continues to have significant growth prospects as it targets 1 million ounces by 2023 – a 67% increase from 2017 year-end levels. The company's cost profile is also decreasing with operating cash costs at Fosterville under $300 per ounce.

The Fund held a 23.0% cash weighting at month end. We expect cash balances to move lower as we progress through the CCVMF's investment process. In the meantime, we look forward to tracking the progress of the portfolio’s current holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

We thank you for your continued support.

The CCVMF Team

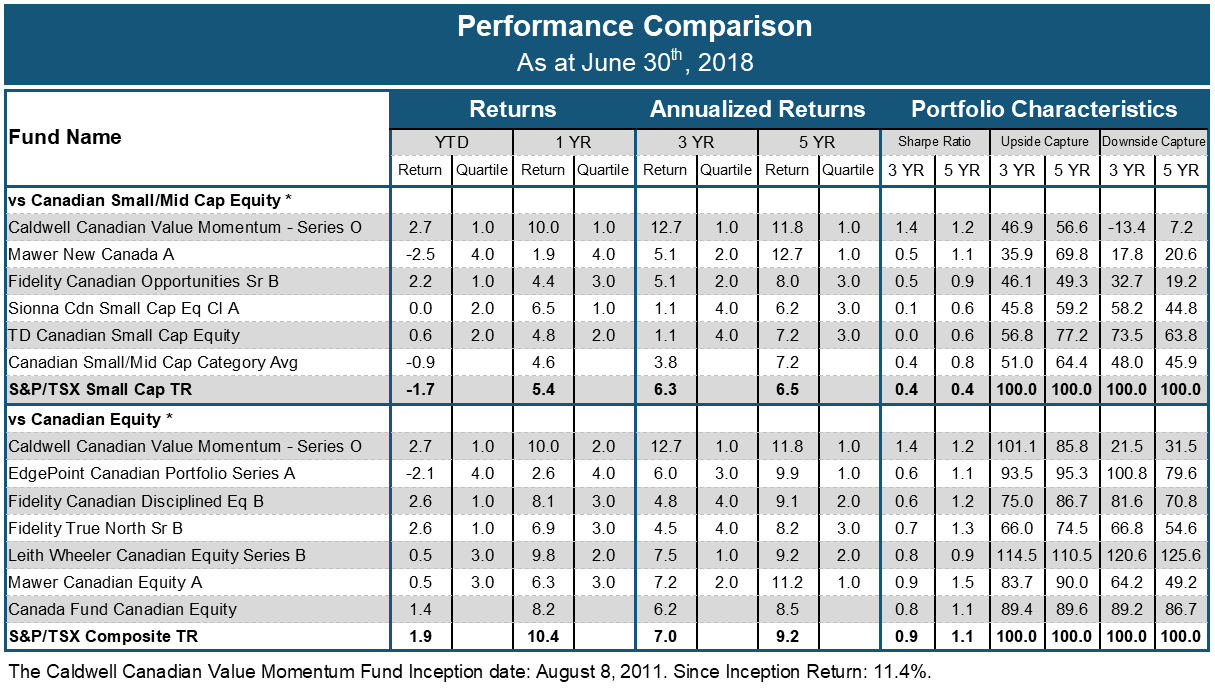

The information contained in this document is designed to provide general information related to investment alternatives and strategies and is not intended to be investment or any other advice applicable to the circumstances of individual investors. We strongly recommend you to consult with a financial advisor prior to making any investment decisions. Unless otherwise specified, information in this document is provided as of the date of first publication and will not be updated. All information herein is qualified in its entirety by the disclosure found in the CCVMF’s most recently filed simplified prospectus. Information contained in this document has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing in this product. Unless otherwise indicated, rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The CCVMF is a publicly offered mutual fund that offers its securities pursuant to simplified prospectus dated July 20, 2017. The CCVMF was not a reporting issuer prior to that date and formerly offered its securities privately as follows: Series F and Series I since March 28, 2014 and Series O since August 8, 2011. The expenses of the CCVMF would have been higher during the period prior to becoming a reporting issuer had the fund been subject to the additional regulatory requirements applicable to a reporting issuer. Inception Date: August 8, 2011. Principal Distributor: Caldwell Securities Ltd.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/