Update on Caldwell Canadian Value Momentum Fund February 2017

Accredited Investors Only

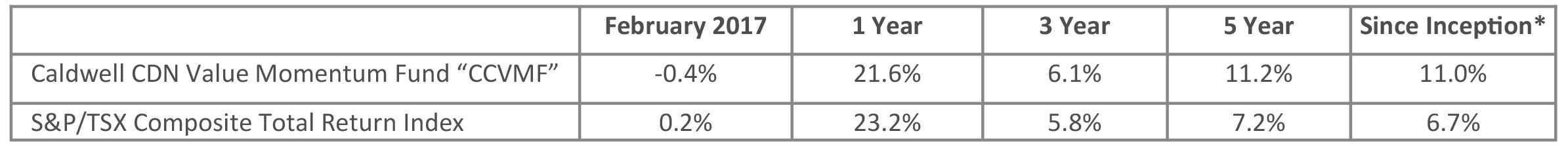

*Compounded Annual Return since August 15, 2011

February Recap: The Fund declined 0.4% in February versus a slight gain of 0.2% for the S&P/TSX Composite Total Return Index (“Index”).

Top CCVMF performers in February were RDM Corp (+13%), Wi-Lan (+11%) and New Flyer (+5%). RDM announced it was being acquired by a U.S. company called Deluxe Corporation for $72M in cash, a 14% premium to the stock’s previous day’s close. While we would have liked a bit more of a premium, it was nice to finally see one of our holdings get taken out. Wi-Lan’s stock moved higher as Q4 results were well ahead of expectations. After two quarters of weaker results, we were expecting a strong quarter given the contract nature of the business makes for lumpy results. We expect strong results to continue and expect the share price to move higher accordingly. New Flyer’s management has been on the road meeting with investors. While many companies will say that it is still too early know the new Trump administration’s impact on their businesses, given New Flyer’s high corporate tax rate and that the company is already “Buy America” compliant, it is likely that the new political landscape will be a net benefit to New Flyer. In addition, the company will likely exceed its original synergy targets on the MCI acquisition and their backlog provides a great deal of visibility on future production.

Two stocks were added to the portfolio in February: North American Energy Partners (NOA) and High Arctic Energy Services (HWO). NOA provides construction services mainly to the oil sands industry. Cash flow is expected to grow 15% annually over the next 3 years as oil sands companies look to increase production to cover high fixed costs. NOA is also actively pursuing opportunities in non-energy related infrastructure work. HWO’s roots lie in its drilling operations in Papa New Guinea, where operating results have performed much better than its North American peers. The cash flow from this business was used to make an acquisition in late 2016 that established HWO as a major player in Western Canada’s service rig market, a subsegment of the energy services industry where supply and demand fundamentals are more attractive. This coincided with the company bringing in an industry veteran with a successful track record of value creation as its new CEO. HWO trades at a significant discount to peers and we expect this gap to close as the Canadian business becomes a larger part of the overall company.

We have spent a lot of time working through a number of commodity-related companies. Our goal was to buy only those companies that have momentum drivers beyond simply the underlying commodity price. While we believe we found this in NOA and HWO, we also know that the market can be blind to unique stories within the commodity space if there is a strong risk-on or risk-off move in the underlying commodity or its sentiment. As such, we have limited our weightings in these names and are keeping a close eye on our stop losses. As previously stated, the strong sector rotation within the Canadian market over the past two years has made it a challenging environment for strategies that have a momentum component in their factor models. We are quite pleased with how we have navigated this market thus far which, we believe, points to the need for an active-overlay in any quantitative model.

The Fund held a 7% cash weighting at month end. We look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

We thank you for your continued support.

The CCVMF Team

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/