QUICK NEWS: We now have the CCVMF in a low-load option: CWF711. Please contact Jennifer Kuta or Alex Osborne for details.

August Recap:

The Fund gained 1.65% in August versus a loss of 0.82% for the S&P/TSX Composite Total Return Index ("Index”). The Index was driven by Energy (-4.0%) and continued weakness in the so called 'safe' dividend-paying stocks found in the Consumer Staples (-1.7%), Utilities (-1.3%) and Telecom (-0.9%) sectors. The gold sub-industry also took a big hit, down 13.0% in August.

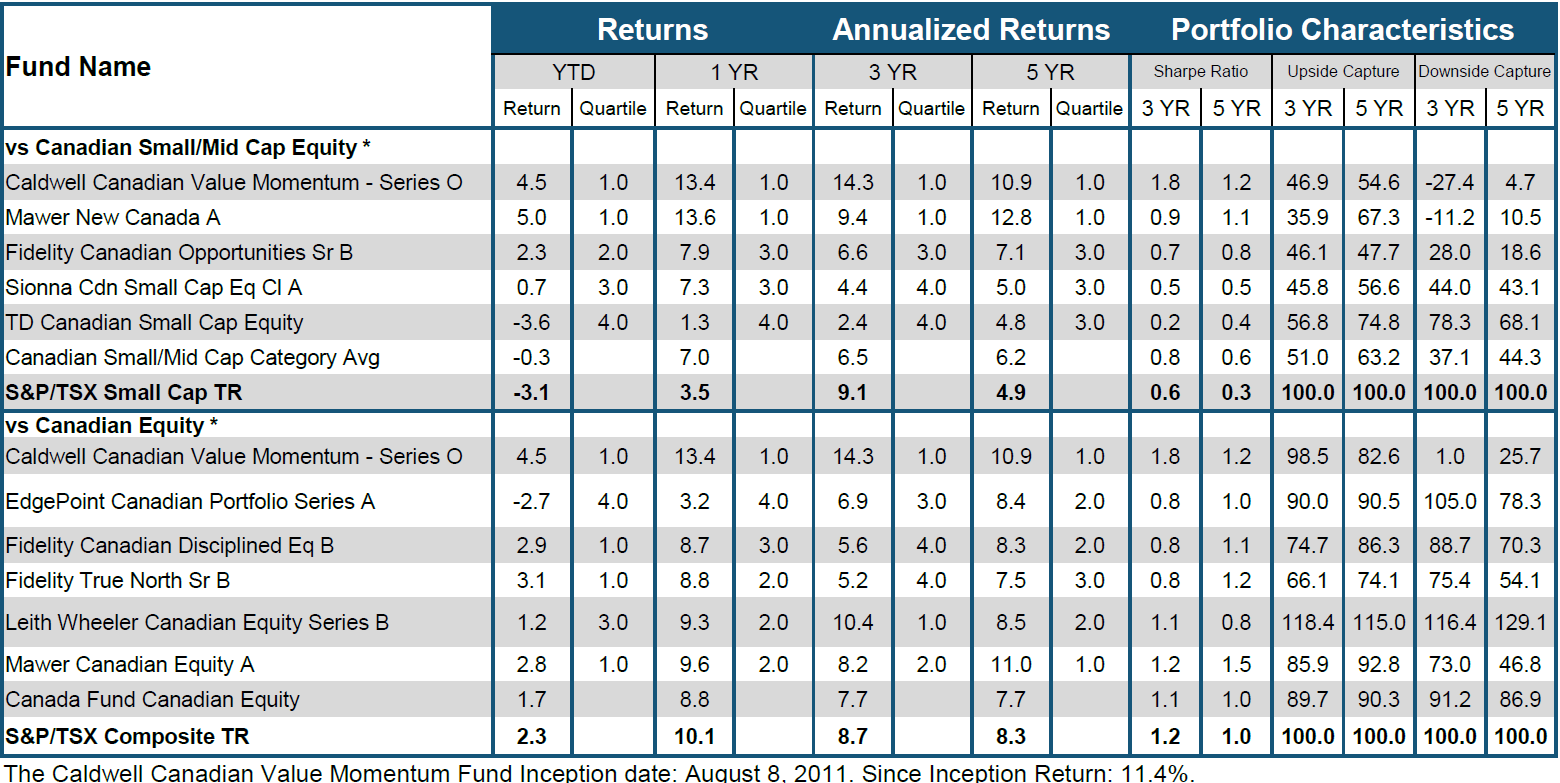

This is the 4th consecutive time the CCVMF out-performed the Index in a down market. Since inception (Aug 2011), the fund has outperformed the Index in 24 of 31 down months for a 77% success ratio. The CCVMF's down capture in August was actually negative (a good thing) given the Fund posted a positive return in a negative market.

The CCVMF has achieved peer-leading performance versus the Index since its inception. As we have previously stated, the keys to that success are owning a concentrated portfolio of companies that have strong catalysts driving their share prices higher. August was a great example of that model at work. The portfolio's strength was broad-based with 10 stocks posting a positive return in a down market. Six of these stocks gained over 10%, driven by company-specific catalysts (NOA, CJT, ATA, DOO, TFII, AFN).

Top CCVMF performers in August were North American Energy (“NOA”: +16.2%) and Cargojet (“CJT”: +15.0%). NOA reported a big earnings beat and raised annual guidance well above the market's expectations. The strong results are being driven by multiple catalysts which led to a backlog that grew to $328 million from $83 million in the prior quarter. Cargojet also reported results that beat expectations. The company continues to have several growth drivers in place to increase revenue, driven by the growth in cargo services, including e-Commerce tailwinds.

One stock was added to the portfolio in August: Toromont Industries (“TIH”). The company operates one of the largest and most successful Caterpillar dealerships in Canada. It is a well-managed company with a long track record of strong earnings growth and peer-leading return on capital. TIH is well positioned for growth driven by their recent acquisition of Hewitt Equipment, the authorized Caterpillar dealer for Quebec and West Labrador. The deal brings significant opportunities to take TIH's successful playbook to new markets while increased infrastructure spending should continue to drive demand over the next several years.

The Fund held a 30.5% cash weighting at month end and 23.8% at the time of writing. Cash balances have been slow to move lower; while we have added new stocks, others have fallen out of the portfolio. We will continue to be disciplined in what we own in the portfolio and expect cash balances to move lower over time. In the meantime, we look forward to tracking the progress of the portfolio’s current holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

We thank you for your continued support.

The CCVMF Team

The information contained in this document is designed to provide general information related to investment alternatives and strategies and is not intended to be investment or any other advice applicable to the circumstances of individual investors. We strongly recommend you to consult with a financial advisor prior to making any investment decisions. Unless otherwise specified, information in this document is provided as of the date of first publication and will not be updated. All information herein is qualified in its entirety by the disclosure found in the CCVMF’s most recently filed simplified prospectus. Information contained in this document has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing in this product. Unless otherwise indicated, rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The CCVMF is a publicly offered mutual fund that offers its securities pursuant to simplified prospectus dated July 20, 2017. The CCVMF was not a reporting issuer prior to that date and formerly offered its securities privately as follows: Series F and Series I since March 28, 2014 and Series O since August 8, 2011. The expenses of the CCVMF would have been higher during the period prior to becoming a reporting issuer had the fund been subject to the additional regulatory requirements applicable to a reporting issuer. Inception Date: August 8, 2011. Principal Distributor: Caldwell Securities Ltd.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/