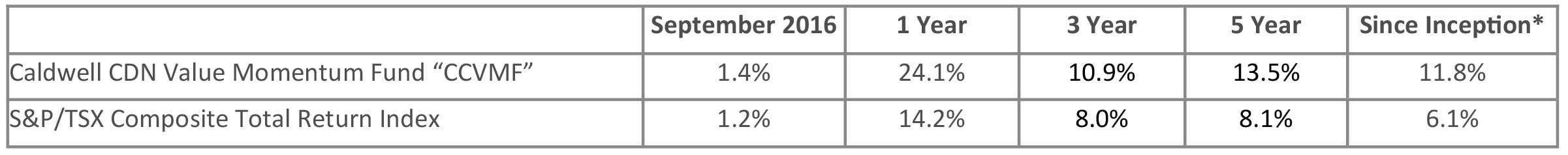

Update on Caldwell Canadian Value Momentum Fund September 2016

*Compounded Annual Return since August 15, 2011

September Recap: The Fund gained 1.4% in September versus a gain of 1.2% for the S&P/TSX Composite Total Return Index (“Index”). Health Care was once again the worst performing sector in the market with a loss of 10.1%. This was driven by a 15% decline in Valeant Pharmaceutical and a particularly painful loss of 49% by Concordia International. These two stocks are now down 77% and 90%, respectively, in 2016. Our focus on stocks with positive momentum, as well as our disciplined due diligence process that aims to confirm the validity of buy and sell signals produced by our quantitative model, helped us to avoid this painful area of the market for our investors.

Top CCVMF performers in September were Tree Island Steel (+21%) and ZCL Composites (+11%). The shares continued to climb higher following previously announced earnings and news releases.

Cargojet was added to the portfolio in September. The company has established itself as the leading overnight air cargo provider in Canada, operating with 90% market share. The company provides time-sensitive deliveries for customers that include UPS, Canada Post, Purolator, FedEx, Amazon and Transforce. Cargojet is coming off of an investment period in which it expanded its fleet to 22 aircraft following a big contract win with Canada Post. The company is now set to leverage this added capacity by expanding its geographic reach and operating its fleet throughout the day. We also like that recent investments have created significant barriers to entry, and that 75% of its core overnight revenue is contractually guaranteed. We expect to see the shares move higher on improving margins and growing free cash flow.

There are two ways a portfolio can add value relative to an index: sector bets (i.e. owning the right business sectors) and security selection (i.e. owning the right stocks). An attribution analysis of the Fund’s performance thus far in 2016 shows that security selection accounts for over 100% of the out-performance over the Index this year (sector bets detracted from relative performance given the Fund’s previously communicated avoidance of the volatile gold and energy sectors). The analysis supports our comment last month where we noted the CCVMF’s ability to own catalyst-rich stocks that are growing in value. These are stocks where: 1) something good is happening at the company; 2) the ‘something good’ has started to be recognized by the market; but 3) the market is only in the earlier stages of recognizing the company’s full value. Having a good stock-picker on your side is important – especially in today’s low growth world – and we are amongst a very few fund managers in Canada that provide this investment approach.

The Fund ended September with a cash balance of 8%. We look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/