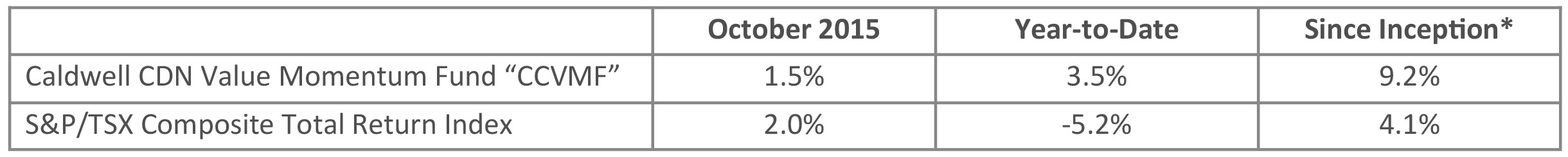

Update on Caldwell Canadian Value Momentum Fund October 2015

*Compounded Annual Return since August 15, 2011

October Recap: The Fund gained 1.5% in October versus a gain of 2.0% for the TSX Total Return Index. After significant declines in recent months, the Energy and Materials sectors rose sharply in October, gaining 7.6% and 7.0%, respectively. The Fund’s relative performance was impacted by this reversal of weakness, along with the Fund’s cash balance (20% of the portfolio). The Fund continued to successfully avoid the most painful parts of the market; specifically, the Health Care sector, which, after significant weakness in September, lost another 45.7% in October, driven by Valeant (VRX -48.8%) and Concordia Healthcare (CXR -29.8%). These losses were in response to a shortseller report issued in September that accused Valeant of fraud and created uncertainty around its acquisition strategy. Concordia, whose CEO came from Valeant and is also pursuing an acquisition strategy, sold off in sympathy.

The short seller’s playbook to target acquisition-driven companies quickly moved to other sectors of the market and impacted two of the Fund’s holdings: DH Corp (DH -9.9%) and Alimentation Couche-Tard (ATD.B -8.3%). A report targeting DH argued the market was over-estimating the company’s growth prospects, which were being made to look artificially strong in part by acquisitions. A number of acquisition-driven companies, including ATD.B, sold off in sympathy. DH’s management was quick to address the report’s accusations on its earnings call the following day. We thought management defended the company well and exposed significant flaws in the report’s short thesis. We continue to hold both DH and ATD.B in the Fund.

Individual holdings continued to perform well, with 60% of the portfolio’s holdings outperforming the market. Top performers this month were AGT Food & Ingredients (AGT +12.8%), Premium Brand Holdings (PBH +9.7%) and Clearwater Seafood (CLR), which was purchased during the month after the company announced the acquisition of British seafood company, Macduff Shellfish Group. The acquisition is expected to materially increase Clearwater’s seafood supply and adds 20% to ebitda on trailing numbers (i.e. ex growth and synergies). Global demand for seafood remains robust as part of the move to healthier eating, and the deal is in line with Clearwater’s long-standing strategic goal to grow access to supply, which is often constrained by permitting. The deal is highly accretive to earnings per share estimates and has driven shares 12.8% higher since the position was added to the portfolio.

Looking forward, we continue to identify stocks with near-term catalysts to unlock value.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/