January Recap:

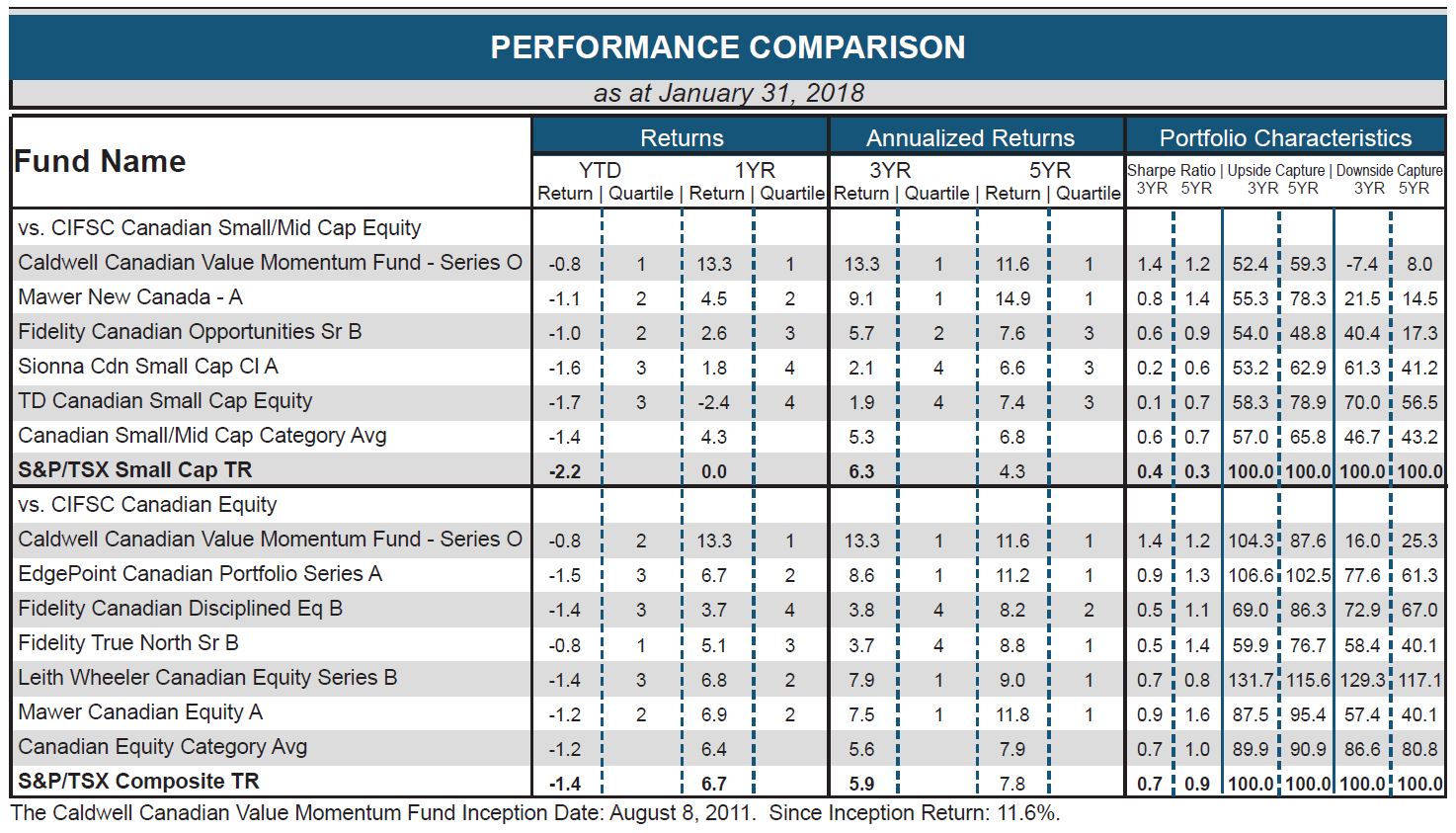

The Fund fell 0.8% in January versus a more substantial loss of 1.4% for the S&P/TSX Composite Total Return Index ("Index”). Last month's out-performance of traditionally defensive sectors reversed in January with Consumer Staples (-1.9%), Telecom (-4.5%%) and Utilities (-4.5%) under-performing in a down month. Technology was the best performing sector in the market (+5.4%).

Top CCVMF performers in January were BRP Inc. (+9.4%) and Ag Growth International (+6.6%). BRP was out marketing in January and pointed to continued strength in end markets and continued runway in penetrating new product categories. Meanwhile, Ag Growth seems to be picking up after drifting lower in a seasonally weaker period. We are encouraged to see renewed buying interest in the stock as there has been no change to the company's significant growth opportunities tied to the build-out of agricultural infrastructure.

Two stocks were added to the portfolio in January: North American Energy Partners (NOA) and Stuart Olsen (SOX). NOA has done a very good job of improving its business through balance sheet and margin improvements and end market diversification. The company invested through the down-cycle and is now well-positioned to take advantage of an up-tick in activity. Stuart Olsen is expected to benefit from infrastructure spending coming out of Canada's 2015 federal election, which is only now starting to hit the market. The stock trades at a significant discount to peers and we expect this gap to narrow as activity picks up and operating metrics improve.

The bigger story is the market's behavior once February started. We will have more color in next month's note but we are pleased with how the CCVMF has navigated the market's volatility thus far. Specifically, the fund continues to exhibit defensive qualities on the down-side while, at the same time, retaining strong participation in the market's upside.

The Fund held a 33.8% cash weighting at month end. As previously discussed, we expect cash balances to move lower as we progress through the CCVMF's investment process. In the meantime, we look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

We thank you for your continued support.

The CCVMF Team

The information contained in this document is designed to provide general information related to investment alternatives and strategies and is not intended to be investment or any other advice applicable to the circumstances of individual investors. We strongly recommend you to consult with a financial advisor prior to making any investment decisions. Unless otherwise specified, information in this document is provided as of the date of first publication and will not be updated. All information herein is qualified in its entirety by the disclosure found in the CCVMF’s most recently filed simplified prospectus. Information contained in this document has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing in this product. Unless otherwise indicated, rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The CCVMF is a publicly offered mutual fund that offers its securities pursuant to simplified prospectus dated July 20, 2017. The CCVMF was not a reporting issuer prior to that date and formerly offered its securities privately as follows: Series F and Series I since March 28, 2014 and Series O since August 8, 2011. The expenses of the CCVMF would have been higher during the period prior to becoming a reporting issuer had the fund been subject to the additional regulatory requirements applicable to a reporting issuer. Inception Date: August 8, 2011. Principal Distributor: Caldwell Securities Ltd.

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/