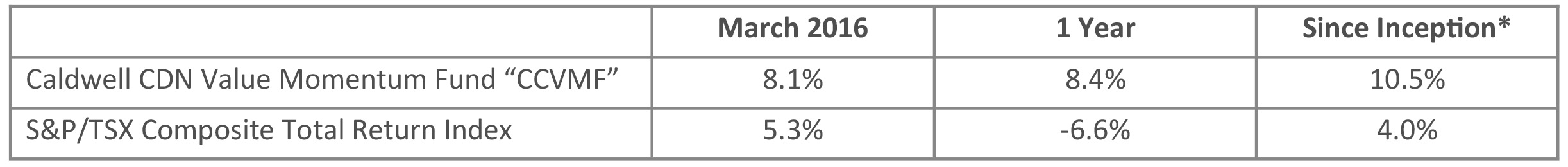

Update on Caldwell Canadian Value Momentum Fund March 2016

*Compounded Annual Return since August 15, 2011

March Recap: The Fund gained 8.1% in March versus a gain of 5.3% for the TSX Total Return Index. After a cautious tone to start the year, the ‘risk-on’ trade showed up with full force in March.

Top performers in March were New Flyer (+29%), Boyd Group (+20%) and CCL Industries (+19%). New Flyer moved higher after a strong Q4 report that included higher margins and continued opportunity for growth given a growing backlog and bid universe. The market is also looking forward to synergies from their recent acquisition of MCI, which currently appear understated. Boyd also had a strong report with same store sales growth of 6% and solid margin expansion. The company re-iterated its outlook to double revenue over the next 5 years through organic growth and continuation of its acquisition strategy. CCL Industries made its largest acquisition to date by acquiring Checkpoint Systems, a leader in technology-driven label solutions for the retail/apparel market. The deal gives CCL an entry into a new vertical, expands its international reach and is immediately accretive to earnings per share.

The team has been busy working through due diligence over the last couple of months; four stocks were added to the portfolio in March as a result: ZCL Composites, Wi-Lan, RDM Corporation and IBI Group. ZCL makes fiberglass-reinforced plastic tanks used to store petroleum, water and other chemicals. Gas stations, whose earnings are more tied to growth in miles driven than lower oil prices, are the primary customer and are expected to support demand as they replace corrosive steel tanks that have come to the end of their useful life. Wi-Lan acquires and licenses patent technology related to wireless access (3G/4G, wifi, Bluetooth), digital TV and display technology. The company recently acquired a patent portfolio that sets the stage for new license agreements over the next several years. IBI Group is an architecture, engineering and planning services company operating in the areas of public transportation, education and hospital buildings and multi-residential. We see significant upside in shares on higher infrastructure spend from federal and provincial budgets, a growing margin profile and the closing of the stock’s substantial discount to peers. RDM provides remote deposit capture (RDC) software and digital imaging scanners/hardware to the payment processing market. Adoption of the company’s RDC software is expected to provide continued growth to an already sizeable recurring revenue base. The company is attractively valued, has a high cash component on its balance sheet and is under-covered with only one analyst following the name.

The Fund is nearly fully invested with the cash balance dropping to 4% at the end of March from 23% at the end of February. We are excited about this new crop of investments as they plant the seeds for continued growth. Looking back at the Fund’s holdings at the beginning of 2015, a year in which the Fund outperformed the Index by 16% (+7.8% versus -8.3%), we note that all but 4 of today’s holdings are new to the portfolio. This suggests that: 1) there is continual opportunity to identify stocks undergoing a positive re-rating by the market; 2) it is possible to continue to outperform, even after a year of stellar results.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/